Give us a call or complete the form and we’ll match you with your Agent — one who knows what home means to a Veteran.

Let us help you

buy a new home

You can buy a home without a single dollar

With the NewDay Home Program, it’s possible — and it’s exclusively for Veterans. At NewDay, your service is your down payment. And to help with other upfront closing costs, there’s the NewDay Home Advantage Loan — a personal loan designed to work with your NewDay Home Mortgage.

You can choose to use it for all or part of those costs, so you won’t need to come up with a single dollar. It’s just one more way NewDay helps make homeownership possible for Veteran families.

Give us a call or complete the form and we’ll match you with your Agent — one who knows what home means to a Veteran.

Start making your new house a home — a place to build memories for you and your family.

With NewDay Home, you’ll have an Admiral-Certified Real Estate Agent* in your area — someone who understands Veterans and knows what it means to serve. This trusted professional is ready to help you find the home of your dreams. They’ll listen. They’ll guide you. And they won’t stop until they help you find a home that feels right — no settling for second best.

Your Admiral-Certified Agent* will team up with a NewDay VA Home Loan Expert to make the process fast and simple. Your Loan Expert will do the VA paperwork for you and get you approved in minutes.† Yes, minutes! In as little as thirty days, you can have the keys to your new home.

Why Veterans choose the NewDay Home Advantage Loan

Join more than 100,000 Veterans

who trust the NewDay USA team

Buy a home without a single dollar Buy a home without a single dollarAre you eligible?

- Active-duty service member

- Veteran with honorable discharge

- Reservist / National Guard with honorable discharge and sufficient time served

- Surviving spouse of an eligible deceased Veteran

- Spouse of a MIA / POW service member

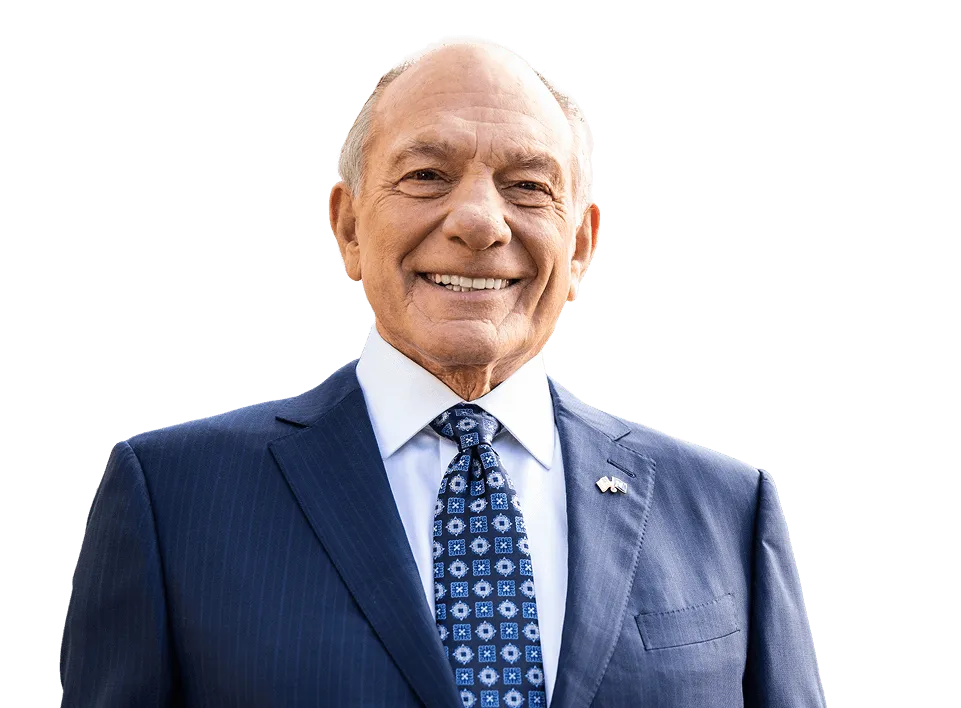

“We can say YES to a Veteran, when other lenders say NO.”

“We can say YES to a Veteran, when other lenders say NO.”NewDay Home Loan FAQs

The Advantage Loan is an unsecured personal loan designed to work with your NewDay Home Mortgage. It is utilized to cover the closing costs on the purchase of your new home. Instead of paying for closing costs up front, you borrow money to cover them. This potentially provides you with greater flexibility in your homebuying decision because you can use your savings for other things.

Similar to other personal loans, it will have a monthly payment due. The monthly payment owed will be due on the same date as your NewDay Home Mortgage. You will receive a statement for your mortgage loan and a statement for your Advantage Loan at the same time every month.

While not required, we generally recommend involving a Real Estate Agent to give you the peace of mind that the Agent is working for you so the contract will be constructed in your best interest. With NewDay Home, you’ll have an Admiral-Certified Real Estate Agent* in your area to help you find the perfect home.

Since VA loans do not have any prepayment penalties, you can pay off a VA home loan early without worrying about a prepayment fee.

The VA-backed home loan limit refers to the amount the VA will guarantee (the maximum amount the VA will pay to your lender if you default on your loan). Except under certain circumstances, the VA does not limit how much you can borrow to finance a home. If you apply and are eligible for a VA-backed home loan, you’ll receive a Certificate of Eligibility (COE). This is the document that tells lenders that you have VA home loan eligibility and entitlement.

But your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:

- Credit history

- Income

- Assets (items of value such as savings, retirement, and investment accounts)

VA home loan limits are the same as the Federal Housing Finance Agency (FHFA) limits. These are called conforming loan limits and are published by FHFA. (Check current loan limits)

Generally, all Veterans using the VA Home Loan Guaranty benefit are required to pay the VA funding fee. This fee is a percentage of the total loan amount. The exact percentage depends on the type of loan, the amount of the down payment, and if this is a first-time or subsequent use of the home loan benefit.

Depending on service history and loan type, the VA funding fee is typically between 0.00% and 3.3% of the total loan amount. More information about the funding fee amount is available from the VA.

Not everyone is required to pay the VA funding fee. According to the VA, you do not have to pay the fee if you are a:

- Veteran receiving VA compensation for a service-related disability, OR

- Veteran who would be entitled to receive compensation for a service-related disability if you did not receive retirement or active duty pay, OR

- Surviving spouse of a Veteran who died in service or from a service-related disability.

Disabled Veterans who are receiving compensation for a service-related disability are exempt from the VA funding fee. Additionally, Veterans who are eligible for disability compensation for a disability but are receiving retirement or active duty pay instead, are also exempt.

Generally, there is no down payment requirement for VA purchase loans as long as the consumer stays within the loan limit for his or her geographic area and the sales price does not exceed the appraised value of the property.

Take advantage of a Zero Down VA Home Loan today with NewDay USA.

It may be possible for you to use your VA home loan benefit to apply for a VA loan to purchase a condo in a VA-approved project. Service members are often happy to learn that they can purchase a condominium with a VA home loan. However, the condominium must meet qualifying guidelines set forth by the VA.

The easiest way to determine if a prospective condo is approved by the VA is to visit the Department of Veterans Affairs condo report page. From there, you simply need to enter in the condo name or ID, the regional office with which the condo is registered, and the location of the condominium.

Apply today for a NewDay USA Zero Down VA Home Loan if you are interested in buying a condo that is eligible for a VA loan.

The VA Home Loan is a really great deal for Veterans. Imagine buying a home without needing a down payment, without having to pay extra each month for mortgage insurance, and getting competitive rates even if your credit score isn’t perfect.

This is a unique chance for Veterans to receive their slice of the American dream that they’re entitled to, and have sacrificed so much for.

I want to buy a home I want to buy a home

Veterans — you may qualify for lower interest rates with a VA Home Loan, which can be more competitive than many conventional mortgages. With a VA loan, you can buy a home with no down payment, avoid the need for monthly mortgage insurance, and pay off your loan at any time without a prepayment penalty.

These advantages are possible because the VA guarantees a portion of the loan, which helps lenders offer favorable terms. That makes the VA loan a powerful benefit to help you save money and achieve homeownership — even if your credit isn’t perfect.